Messi was injured and missed two Argentina matches.

Without Messi, Luis Suarez shines and Inter Miami triumphs.

The parent firm of White Claw has reportedly partnered with soccer star Lionel Messi to develop Más+, a new electrolyte supplement drink. With this, he enters a $33 billion market that is now dominated by Prime, Gatorade, and BodyArmor, three well-established competitors.

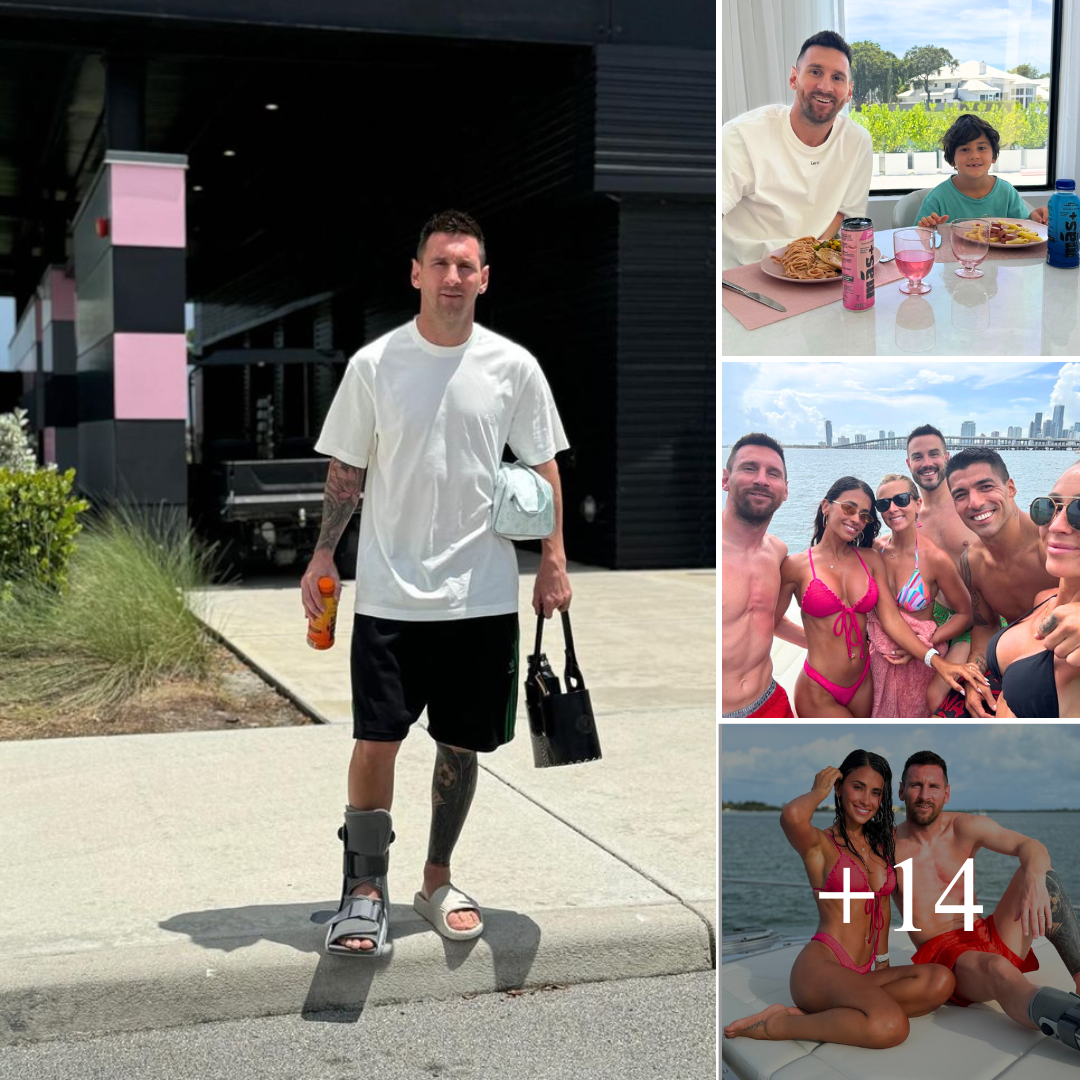

Lionel Messi with his wife, Antonela Roccuzzo and three sons promote the new beverage product Más+. Photo: Instagram leomessi

Given that Americans are currently drinking less alcohol, Mark Anthony Brands’ product, which is owned by Messi and White Claw, is also the company’s first venture into the non-alcoholic beverage market.

Más+ is a low-sugar beverage free of artificial sweeteners, colors, and caffeine that is rich in electrolytes and vitamins. This product comes in four flavors in cans. It will be introduced in Miami, USA, on June 13 and will go on sale in bigger quantities on the company’s website in July and August, respectively, when it reaches US supermarkets. A worldwide debut is scheduled for later this year.

The US Football Federation reported that since Messi joined the US Professional Soccer League (MLS) on July 15, 2023, sponsorship revenue has increased by 15% to $587 million. Notable brands like Celcius have been named the official energy drink of the competition. The American Football Federation took its time to respond to Messi’s Más+ drink, which could pose a threat to Celcius.

Precedence Research projects that the market for energy drinks and hydration and electrolyte beverages will reach $60 billion by 2032, expanding at a rate of roughly 6% annually.

Experts advise caution.

But adding Messi’s name to a drink doesn’t ensure success because established firms dominate this competitive market, according to Andrea Hernández, the founder of Snaxshot, a platform for food and drink insights.

According to Ms. Hernández, “the category is saturated, so it all depends on parity in price and distribution,” presuming Messi strikes some solid agreements to try and seriously compete with brands like Gatorade, BodyArmor, and Prime in addition to others. Their sole benefit is that the product is associated with Messi’s persona.”

But Messi’s following is growing, and in a market as big as Latin America, he’s practically a hero to the next round of players, according to Ms. Hernández. The renowned boxer Logan Paul’s beverage product, Prime, has not even gained traction or distribution in that area, the female expert continued.

The drink owned by Messi is about to launch on the market with 4 flavors for customers to choose from – Photo: Más+

Additionally, Ms. Hernández pointed out that Messi’s drinks include cane sugar, which is a recent development in the beverage industry because some people find sugar-free drinks to be uncomfortable due to their bad flavor.

According to Ms. Hernández, “people forget how much a product tastes good.” These new generation energy drinks are aimed at the Alpha Gen, who are up for grabs, especially as they approach adolescence.

Messi and his associates have great expectations for the new product Más+, but it’s evident that there are still many “thorns” in the way of this soccer star becoming a “shark”—a term used to describe a wealthy businessman—in the US beverage industry.

Messi, on the other hand, continues to excel on the American pitch. The 36-year-old striker known as “La Pulga Atomica” (Atomic Flea) helped Inter Miami take a brief lead in the standings with 35 points after 12 MLS games this season.